Lower Energy Costs Year-Round with an Insulated Garage Door

A

leaky, uninsulated garage door may not be an obvious culprit in rising

monthly utility bills, but it’s worth a second look if you have an

attached garage.

Replacing an older garage door with a new,

energy efficient model can reduce energy loss through the garage by up

to 71%, according to a comparison study conducted by engineers at Clopay

Building Products, the nation’s leading manufacturer of residential

garage doors.

“Since attached garages typically share one or two

common walls with the house, any hot or cold that travels through a door

will ultimately affect the adjacent living areas,” says Mark

Westerfield P.E., Director of Product Development for Clopay. “An

insulated garage door can help stabilize temperatures in the garage to

reduce heat losses or gains.”

Depending on the specifics of the home,

a well insulated door can help keep an unheated garage 10 to 20 degrees

warmer on a cold winter day. “That can have a significant impact on the

comfort of family rooms or bedrooms located above or next to the

garage,” adds Westerfield.

Homeowners who purchase an energy

efficient garage door by December 31, 2010 will not only save on their

heating and cooling bills, they may qualify for up to $1,500 in federal

tax credits, thanks to the stimulus legislation.

The tax credit is

equal to the sum of 30 percent of all qualified energy saving

improvements, which includes garage doors, installed in an existing home

from January 1, 2009 to December 31, 2010.

For example, if two

new garage doors cost $2,000, the applicable homeowner tax credit is

$600. The credit applies to the product only (not labor) and the maximum

credit for all of the improvements combined is $1,500.

A tax

credit is more valuable than an equivalent tax deduction because it

reduces tax dollar-for-dollar, while a deduction only decreases the

amount of income that is taxed.

Garage doors must meet the following criteria to qualify:

– The door must be an insulated residential garage door placed in service from January 1, 2009 through December 31, 2010.

–

The door must have a U-factor equal to or less than 0.30, and there

must be a means to control air filtration at the door perimeter.

– The door must be expected to remain in service for at least five years.

– The garage must be an insulated space and part of the taxpayer’s principal U.S. residence.

Professional

garage door dealers and retailers should provide a manufacturer’s

certification statement for all qualified insulated garage doors along

with a breakdown of the cost of the door(s) and the cost of labor at the

time of installation. Homeowners do not need to submit a copy with

their tax return, but should keep a copy for their records.

Visit www.clopaydoor.com or call 800-225-6729 for more information and a list of eligible Clopay garage door models.

Helpful Tips

More

than 40 percent of the current housing stock was built prior to the era

of energy efficiency.* If your garage door is a holdover from the dark

ages, here are some things to look for when making an upgrade:

–

2” thick three-layer ”sandwich” construction – environmentally safe,

CFC-free insulation layered between two sheets of heavy-duty galvanized

steel.

– R-value or U-factor – these are measurements of the

thermal efficiency of a door’s insulation. The higher the R-value, or

the lower the U-factor, the more energy efficient the insulation is.

–

Energy tax credit eligible – available for garage doors with a minimum

U-factor of 0.30 installed on a homeowner’s primary residence.

–

Insulation type – There are two different types of insulation used in

garage doors: expanded polystyrene and polyurethane. Doors constructed

from either kind qualify for the energy tax credit, and both are strong

and durable.

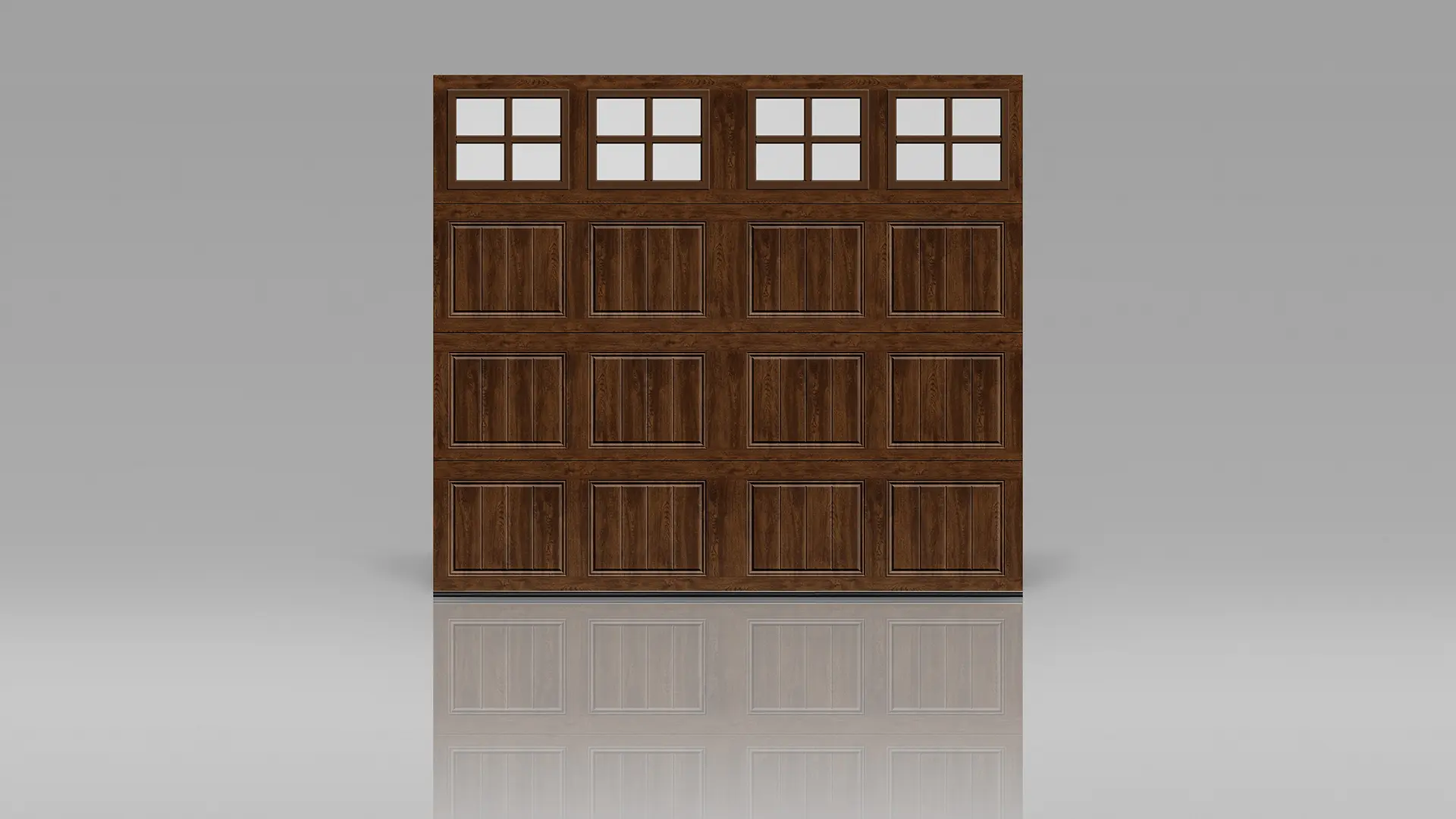

– Design – Get the most out of your garage door upgrade. Choose a model that complements your home’s architectural style.

*2009 report by The Joint Center for Housing Studies at Harvard University